Digitization has spoilt customers in an era when corporations are trying to replicate Netflix or Apple. Consumers desire the same level of personalization, speed of service, and usability from banking software development as from their smartphone apps.

The banking industry has seen a spike in resources committed to digitally modernising a decades-old industry. Neobanks and fintech companies have highlighted traditional banks’ outmoded methods.

The outbreak showed that digital banking channels lack the capability and user experience to meet client expectations. It allowed banks and consumers to recognise that a digital-only connection may be a more effective way to do business. Even banks with underdeveloped digital systems were able to meet new client demands throughout the outbreak.

Most financial institutions lack comprehensive digital transformation plans and struggle to know where to put their efforts and investments. Let’s discuss ways to accelerate digital transformation in banking.

System Modernization

Outdated core banking systems are the biggest digital transformation obstacle. While nimble fintechs offer new features everyday, their older colleagues must maintain outdated systems. Core banking systems are slow, congested, and rigid, making them incompatible with contemporary technology and features.

The costs of maintaining financial systems will only climb. As legacy IT specialists retire, talent scarcity could soon become a problem. Upgraded IT environments attract a younger workforce, making hiring easier. In the context of digital transformation, a new cloud-based core banking system that allows innovation and easy feature releases may be the best replacement for ageing infrastructure.

Banks are reluctant to modernise their fundamental financial systems because of the disruption and significant expenses involved. Historically, banks could replace the entire system or pay more on upkeep. Thanks to cloud technology improvements, banks may now innovate and add new features to fulfil consumer needs and promote digital transformation while preserving legacy systems for other tasks.

Future cloud-based and service-oriented architecture models are API-compatible. This cloud-based approach to core system modernization is safer and cheaper than replacement. Some companies develop a new brand around their cloud platform for digital transformation, while others progressively migrate legacy data.

While enhancing legacy systems seems better on paper, full system replacement may be considered in some cases. System modernisation requires more resources, a clearer long-term vision, and more risks, but it may be a competitive advantage. Full system replacement allows banks to introduce features faster than phased migration. A bank must assess its data architecture, market position, client demands, and current and long-term goals to determine the optimal technique.

Mobile App Appreciation

90% of financial firms prioritise mobile user experience, according to a 2021 report. This isn’t unexpected given that more financial transactions occur online and on mobile devices than at ATMs and banks. The sophistication of online banking services can only explain part of the rise in online activity. Smartphones and other mobile gadgets are projected to grow in popularity.

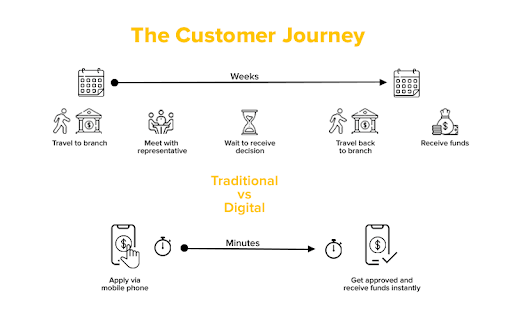

Most incumbent banks’ mobile offerings focus on money transfers and account balance checks. This is the biggest distinction between traditional banks and technology-driven neobanks, which have offered mobile banking for nearly a decade. Some banks provide computerised loan applications, but most customers still prefer to visit a location.

Neobanks encourage consumers to use their online services, rather than just offering them. They give buying-habit data, location-based loyalty discounts, and customised banking. This improves digital consumer engagement and digital transformation.

Amazon and other retail giants have built their business strategies around growing engagement through digital experiences. Customers like these organisations’ services because their digital offerings are as good as or better than others’ physical products. Why visit a store when you can get the same quality online? Banks must assist customers comprehend this. Some ideas:

Making your Banking App Awesome

Mobile banking is becoming the key point of interaction between banks and clients in the digital age, so mobile banking apps must offer a great user experience and many functions. Best-case scenario, traditional banking mobile apps provide the same services as branches.

Fintechs have steadily increased their market share by combining various services into a single app that serves as a personal financial hub.

According to a recent EY survey, incumbent bank customers have an average of 2.5 relationships to other financial service providers. This threatens and helps banks. Customers are willing to use many apps to suit their needs, so a one-stop financial solution can be a market differentiator and an effective way to engage digital consumers.

All-in-one mobile banking apps include checking accounts, investments, and personalised money management. A bank can provide comprehensive financial advice based on a customer’s goals and lifestyle choices, improving their financial well-being.

Fintechs offer more of these items, but incumbent banks have a better starting point for establishing ecosystems since they are more trusted. Not all banks must build their own solutions. Depending on the organization’s digital transformation readiness and market position, connecting with neobank ecosystems may be better. While monetizing these relationships can be difficult, it will help increase customer value.

Enhance Security

Mobile banking security worries are a major deterrent to digital change. In several industrialised economies, the old banking infrastructure is so embedded in the average customer’s psyche that anything that changes the status quo looks to be a security risk.

Banks must strengthen their mobile app security (by using AI in cyber security, for example) and push these features to select consumer groups. Biometric authentication and speech recognition are essential. Customer mindsets don’t change rapidly, therefore organisations must build long-term strategies.

Stress Usability

Some client groups may fail to see a smart, convenient digital infrastructure. It’s important to promote mobile banking and digital transformation’s benefits. Banks can create online training programmes to teach new users digital banking technologies. When interacting with consumers via traditional channels, bank workers must actively advocate the benefits of digital banking to accelerate the adoption of digital banking channels and digital transformation in general.

Customize Your Offerings

Mobile banking app features should be based on consumer demands. EY’s poll confirms Deloitte’s conclusion that data security and privacy are top customer concerns. Customers value savings, payments, loyalty programmes, and rate benefits.

Generic goods and services won’t do. According to EY’s study, personalising product offerings is the most successful way to interact with Gen Z customers (who have the highest customer lifetime value). Providing appropriate products and services at the right moment is crucial to developing client loyalty in this scenario.

Banks must conduct considerable research to identify which product offers will be relevant in each region depending on customers’ location and demographics.

Giving Full Virtual Experiences

Changing consumer needs, competition from fintechs, and an unpredictable business landscape need financial institutions to rethink their cost management approaches. Many banks see cost reduction as the only way to generate the funds needed for transformation.

Digital transformation programmes require rethinking investment strategies. Modernizing banking systems often leads to process automation, including RPA, and the elimination of low-value operations, resulting in significant cost savings.

Outsourcing non-core activities is one approach to save money for innovation. In today’s business environment, with complex legislation and rapidly changing technology, outsourcing to external service providers is preferable to investing internal resources to running the organisation. By outsourcing resource-intensive tasks like tax and compliance, banks may maintain profitable operations and save money over time. IT outsourcing risks must be considered, and your company’s vision and values must align with a partner’s.

Conclusion

Digital banking transformation requires significant investment and great leadership. Each digital transformation strategy must be tailored to the organization’s technology maturity, culture, and market. All banks must change from a product-centric to a customer-centric approach and establish a powerful IT infrastructure to support it.

Digital personalization will help banks build emotional connections with customers. Banks should go beyond normal banking offers and create solutions that match their clients’ needs and wants.

Pirimid can helps banks, NBFCs and Fintechs in digitizing their end to end lending journeys. Book a call to understand our solutions in detail.