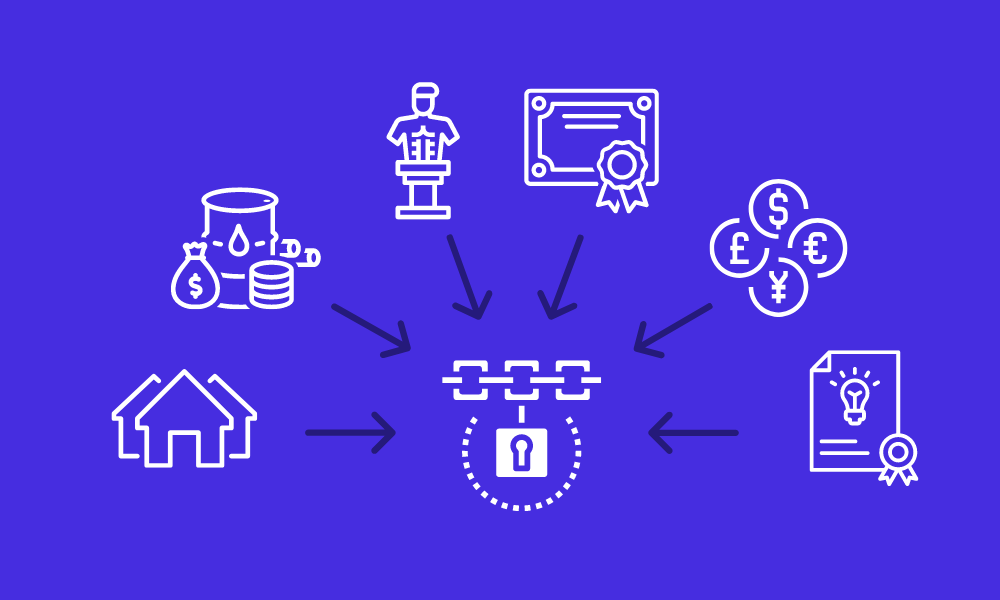

The financial landscape is evolving rapidly, giving birth to a groundbreaking concept: Asset Tokenization. Asset Tokenization is the process of converting real assets into digital tokens. This concept is changing the way people think about investments and capital markets. It is a powerful tool with vast possibilities for investors and issuers. Digging deep into the asset tokenization world, we will learn its potential to reshape traditional investments, democratize investments and streamline the transaction process. Let us see how asset tokenization is changing the financial space.

Understanding Capital Markets and Asset Tokenization

Capital markets are an integral part of the global economy, promoting the flow of capital from investors to businesses and governments. Large institutional investors have always dominated these markets, giving little access to average individuals. With asset tokenization, the scenario will change because individuals can invest in real artworks that must be within the traditional market’s reach.

Asset tokenization has brought easy liquidity to the market. With traditional investments, which took time to sell, tokenized assets can be liquidated easily on digital platforms. This provides more flexibility to the investor and removes dependencies from any third party.

Source: ScienceSoft

Asset tokenization also enables the creation of new financial products, i.e., tokenized funds or indexes, which further expands investment options and cater to different investors with specific needs.

Asset tokenization has been a transformative approach that has the potential to reconfigure the financial market by creating a more efficient and inclusive system for all.

Use Cases in Capital Markets: Real Estate Tokenization

One of the most positive use cases for asset tokenization lies within the real estate sector. High-net-worth individuals have always dominated traditional real estate investments because of their requirement for high capital.

Introducing asset tokenization in real estate will make fractional ownership a reality. It will enable investors to purchase fractional shares of properties, removing any obstacle in entering and making it possible for a wide range of investors to participate in the market.

Use Cases in Capital Markets: Art and Collectibles Tokenization

The tokenization of art has opened new doors for investment and liquidity. It has made possible fractional ownership by converting artwork and collectibles into digital tokens. Now trading can happen at any place on any blockchain-enabled platform. Now without the need for insane capital outlays, Investors can get their hands on renowned artworks or collectibles. Asset tokenization has also bought more security and transparency to the art market by removing concerns about counterfeited products. This normalization of the art market has given investors, artists, and collectors better opportunities and an all-inclusive environment.

Use Cases in Capital Markets: Tokenized Securities

Asset Tokenization can change the issuance and trading of securities. Traditional securities had complex processes, administrative burdens, and intermediaries. Reduced costs, streamlining the issuance process, and transparency are possible with the tokenization of securities. Tokenized securities can easily be traded on digital asset exchanges, making the market accessible 24/7 and making global investor participation possible. Additionally, tokens having smart contracts can increase investor protection and automate compliance requirements. This will improve market efficiency and accessibility while significantly reducing obstacles for small and medium-sized enterprises looking for capital.

Use Cases in Capital Markets: Commodities and Precious Metals Tokenization

commodities and precious metals, if tokenized, can give investors a more flexible and efficient way to access digital markets. Fractional ownership and trading become more accessible if physical assets are used as digital tokens. Investors can be exposed to commodities like silver, gold, or oil without large investments or physical possession. Tokenization reduces fraudulent activities by increasing traceability.

Benefits of Asset Tokenization

There are so many benefits to asset tokenization for both issuers and investors. The benefits of this revolutionary approach are:

1. Fractional Ownership

With asset tokenization, fractional ownership of high-value assets is possible. Investors don’t need to purchase an entire property or artwork; they can own a fraction of the asset as tokens. This concept of the fractional ownership model decreases the minimum investment amount, which makes it more accessible to a broader range of investors.

2. More Liquidity

One of the benefits of asset tokenization is the increase in liquid assets. The digital platform allows investors to sell and buy tokenized assets easily and quickly. This benefit has increased the investors’ flexibility and reduced the obstacles to exit and enter the market.

3. Diversification

With diversification, investors can now easily allocate their capital across different asset classes and geographies, reducing the risk and increasing expected returns. This diversification happened only because of the ability to invest that was unavailable initially fractionally.

4. Efficiency and Automation

Digitization of assets and using smart contracts have helped in many aspects of the investment process. Automation has eliminated the need for intermediaries, streamlining transaction processes and eliminating manual errors. As a result, asset tokenization has helped improve efficiency and cost savings.

5. Transparency and Security

Asset tokenization uses blockchain technology, which provides security and transparency to the capital markets. Blockchain stores the ownership records, which makes them auditable. Transparency reduces the risk of fraud and increases trust.

Challenges and Risks of Asset Tokenization

Asset tokenization offers many advantages but has challenges and risks. Let us see some of them:

1. Regulatory Uncertainty

The regulatory scenario around tokenization is still developing. Different jurisdictions can have different rules and regulations. This uncertainty can challenge investors and issuers as they must undergo complex legalities.

2. Liquidity Limitations

Tokenization has increased liquidity compared to traditional assets, but there are still some limitations subject to market and asset class. Tokenized assets may have limited trading volumes or face liquidity constraints in some situations. Investors should be mindful of the liquidity of tokens before investing.

3. Cybersecurity Risks

Asset tokenization is based on blockchain technology unprotected from cybersecurity risks. Data loss can happen if hacks, breaches, or vulnerabilities happen in smart contracts.

4. Market Volatility

Market volatility is a risk that even tokenized assets have to face. The demand and supply dynamics, market situation, and economic conditions can affect the value of the tokens. Investors should be aware of the risks and accordingly prepared.

5. Market Acceptance and Education

Asset tokenization is a fairly new concept, and education and market acceptance are ongoing challenges. Many investors and issuers need to be made aware of the benefits and the working of asset tokenization which can be a problem.

Future of Asset Tokenization in Capital Markets

The future of asset tokenization in capital markets looks favorable. With the evolution of regulations and industry collaborations’ progress, asset tokenization will become more mainstream. The benefits like fractional ownership increased liquidity, and transparency are pushing the adoption of asset tokenization through different classes.

In real estate, tokenization enables more efficient property transactions giving access to global markets, Art investments will be more accessible and liquid, and private equity investments will be democratized.

Asset tokenization is based on blockchain technology which is also evolving. The advancement will further increase the usability of asset tokenization platforms, opening up new possibilities for issuers and investors.

As capital markets are continuously changed by asset tokenization, it becomes important for industry participants, regulators, and investors to collaborate and navigate for responsible growth.

Conclusion

Asset tokenization can change the capital markets by normalizing investments and increasing liquidity and transparency. It brings new opportunities for issuers and investors. Challenges are manageable. The future of capital markets is tokenized. Let us unlock its potential.